Insurance Chatbot is a cutting-edge InsurTech SaaS platform that redefines how insurance carriers, agencies, MGAs, and brokers interact with customers. At its core, Insurance Chatbot leverages Generative AI-powered chatbots and copilots to provide fully automated, natural-language interfaces that simplify and accelerate insurance operations - from quoting and underwriting to claims processing and customer service.

By combining machine learning, NLP, and insurance domain intelligence, Insurance Chatbot delivers intuitive, personalized, and human-like conversations that meet the needs of modern consumers while improving back-office efficiency.

- To present Insurance Chatbot’s conversational insurance platform and core capabilities

- To explain its AI Agent and Copilot solutions for automating insurance distribution

- To highlight flexibility in deployment—direct-to-consumer, agency, or MGA use cases

- To serve as a lead-generation and demo request portal for insurers and agents

Purpose of the Website

- To introduce insurance chatbot as a next-gen conversational AI platform for the insurance ecosystem

- To showcase key products and capabilities, including AI Agents and Copilots

- To demonstrate real-world use cases across direct-to-consumer, broker, MGA, and embedded insurance models

- To capture qualified leads and drive demo or partnership requests

- To act as a thought leadership hub around AI and digital transformation in insurance

Who is the audience for this custom chatbot??

- Insurance Carriers & Enterprises: Looking to scale service delivery, automate claims, and reduce support costs

- Managing General Agents (MGAs): Wanting to streamline quoting, policy issuance, and renewals with minimal overhead

- Insurance Brokers & Agencies: Enhancing customer experience with 24/7 AI-powered support and lead qualification

- InsurTech Startups: Building embedded insurance products with conversational interfaces

- Product & Technology Leaders: Evaluating AI solutions to modernize legacy systems and enable future-ready workflows

Core Features

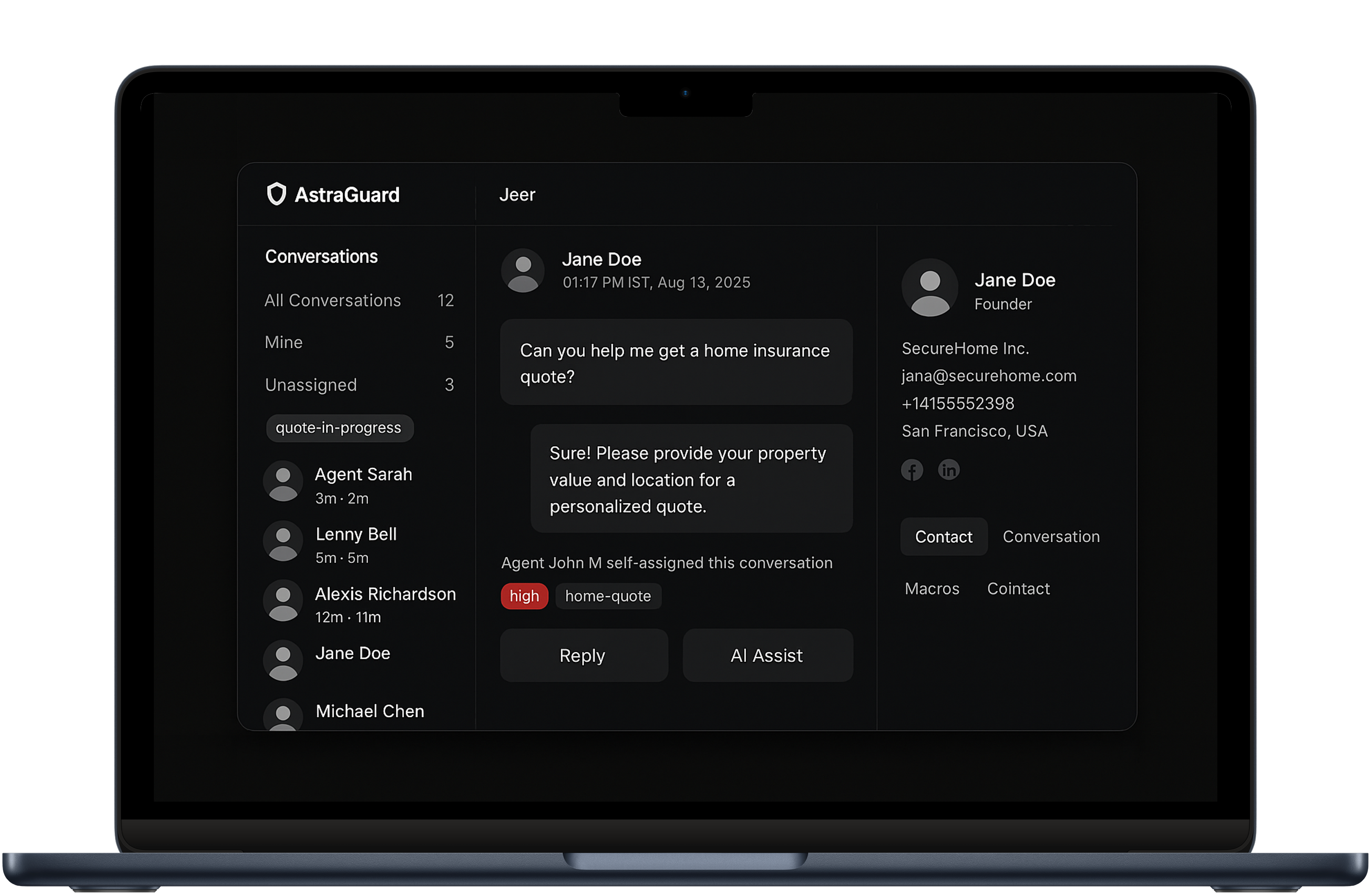

- AI Insurance Agent: Handles quoting, eligibility checks, risk assessment, and instant policy recommendations

- AI Copilot for Agents: Assists human agents with real-time suggestions, policy lookup, and contextual information retrieval

- Claims Automation: Enables users to file, track, and resolve claims through guided conversations

- Multi-Channel Support: Deploy across websites, mobile apps, WhatsApp, or custom portals

- Integration-Ready Architecture: Easily connects with existing CRMs, policy systems, and third-party APIs

- Analytics Dashboard: Gain insights into user behavior, conversion metrics, and operational performance

Technology & Design

- Built on modern frameworks such as Next.js, React.js, and integrated with AI/LLM infrastructure

- Elegant, responsive UI/UX, optimized for both desktop and mobile experiences

- Uses scroll-triggered animations and micro-interactions for a seamless user journey

- Fast-loading, SEO-optimized, and accessible design for all types of users

- Security-first architecture aligned with insurance data protection requirements

Key Benefits

- Accelerates Digital Transformation: Enables insurers to launch AI-native workflows in days, not months

- Drives Operational Efficiency: Automates repetitive tasks and reduces agent workload

- Improves Customer Experience: Offers 24/7 intelligent support with near-human accuracy

- Boosts Conversion & Engagement: Delivers frictionless, intuitive quote-to-bind flows

- Adaptable Across Business Models: Works for B2C, B2B, embedded, and hybrid insurance products

- Keeps You Future-Ready: Continuously learns and evolves with your business through AI training and feedback loops

Why Choose an Insurance Chatbot?

Insurance chatbot is not just another chatbot - it’s a strategic AI partner for insurers, enabling them to thrive in a fast-changing, digital-first world. Whether you're a traditional insurer seeking automation or a startup building next-gen insurance products, Insurance Chatbot helps you deploy smarter, faster, and more customer-centric solutions at scale.